Please refer to important disclosures at the end of this report

1

Incorporated in 1996, Tatva Chintan Pharma Chem Limited (Tatva Chintan) is a

leading manufacturer of Structure Directing Agents (SDAs) and Phase Transfer

Catalyst (PTCs) that have various applications in green chemistry. The company

also manufactures Electrolyte Salts for super capacitor batteries (SCB) and

Pharmaceutical & Agrochemical intermediates and other specialty chemicals

(PASC). Its Product have application industries like automotive, petroleum,

pharmaceutical, agrochemicals, paints and coatings, dyes and pigments, personal

care and flavor and fragrances industries. As of FY21, they offered 47 products

under their SDA, 48 products under the PTC, 6 products under the Electrolyte Salts

for (SCB) and 53 products under their PASC portfolios.

Positives: (a) Leading manufacturer of structure directing agents and phase transfer

catalysts, with consistent quality. (b) Global presence with a wide customer base

across various industries having high entry barriers. (c) Diversified specialized

product portfolio requiring strong technical know-how (d) Modern manufacturing

facilities with a focus on ‘green’ chemistry processes. (e) Strong R&D capabilities.

Investment concerns: (a) Outbreak of the COVID-19 could have a significant effect

on operations, and could negatively impact the business, revenues & financial

condition (b) Unplanned slowdowns or shutdowns in manufacturing operations

could have an adverse effect on business (c) Company is subject to quality

requirements and strict technical specifications and audits by institutional

customers. (d) Increase in the cost of raw materials.

Outlook & Valuation: Tatva Chintan’s is the largest player in India for PTCs and the

only manufacturer in India of SDAs for zeolites which have importance due to

preference for green technologies. The company has shown good revenue and

earnings growth and has healthy balance sheet with solid return ratios. It is raising

funds for Capex and R&D requirements as they believe that there is strong growth

opportunity available. Given the client additions, wide portfolio, its capabilities, and

favorable outlook for the industry, we believe that Tatva Chintan can maintain

healthy growth rates which justifies the ~46x FY21 EPS commanded by the

company. Hence, we recommend “SUBSCRIBE” to the issue.

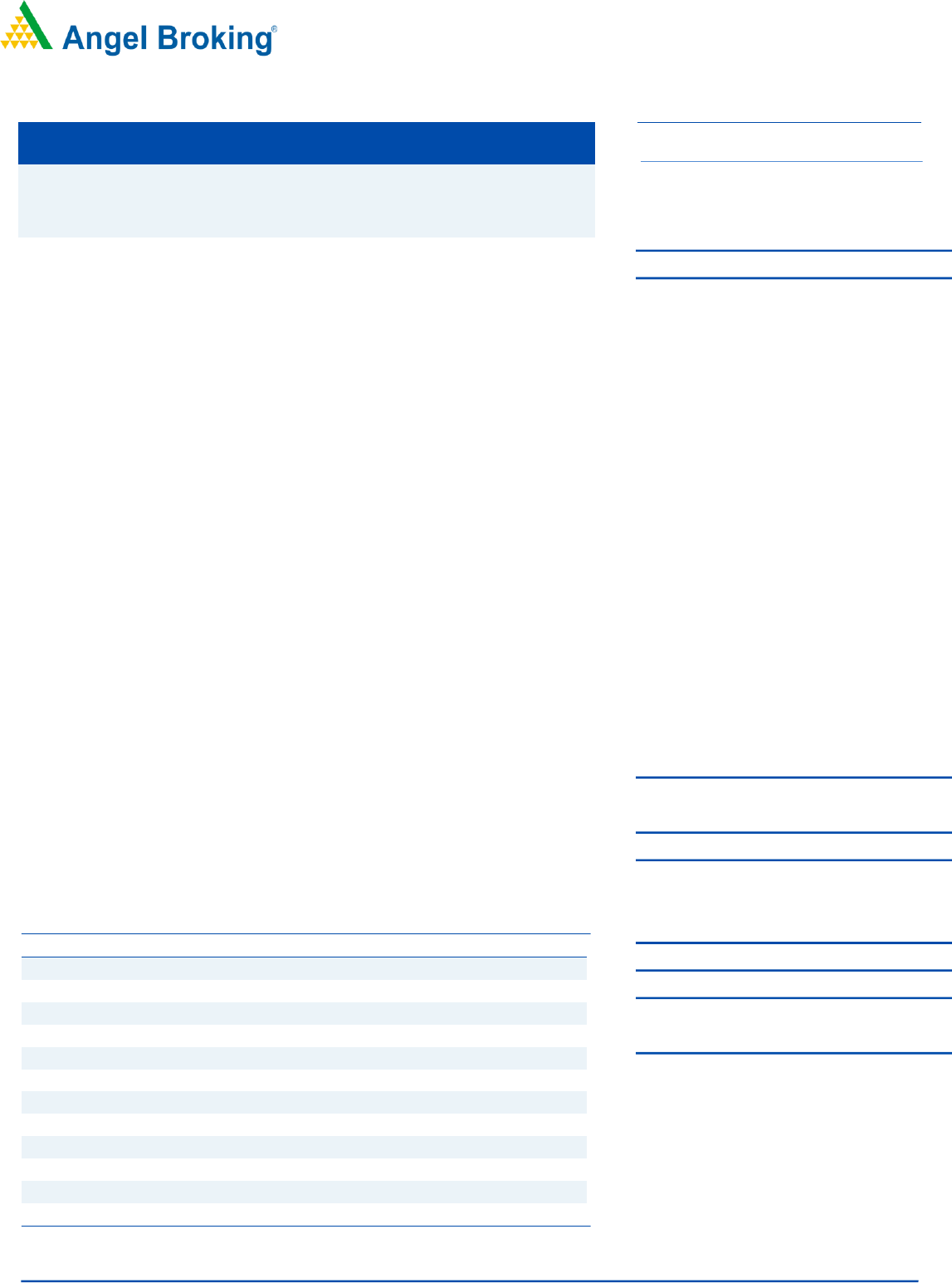

Key Financials

Y/E March (` cr)

FY2019

FY2020

FY2021

Net Sales

206

263

300

% chg

-

27.6

14.1

Net Profit

21

38

52

% chg

-

84.0

38.3

EBITDA (%)

16.4

20.9

21.9

EPS (`)

9.0

17.0

23.6

P/E (x)

120.4

63.5

45.9

P/BV (x)

30.1

20.4

14.5

ROE (%)

50.0

38.3

36.8

ROCE (%)

29.0

22.4

24.1

EV/EBITDA

72.8

45.1

37.8

EV/Sales

11.9

9.4

8.3

Source: Company, Angel Research.

Note: Valuation ratios at upper price band.

SUBSCRIBE

Issue Open: July 16, 2021

Issue Close: July 20, 2021

Offer for Sale: 275 cr

QIBs 50% of issue

Non-Institutional 15% of issue

Retail 35% of issue

Promoters 79.2%

Others 20.8%

Fresh issue: 225 cr

Issue Details

Face Value: `10

Present Eq. Paid up Capital: `20.1 cr

Post Issue Shareholding Patter n

Post Eq. Paid up Capital: `22.2cr

Issue size (amount): `500 cr

Price Band: `1,073-1,083

Lot Size: 13 shares and in multiple thereafter

Post-issue mkt. cap: * `2,380 cr - ** `2,400 cr

Promoters holding Pre-Issue: 100%

Promoters holding Post-Issue: 79.17%

*Calculated on lower price band

** Calculated on upper price band

Book Building

TATVA CHINTAN LIMITED.

f

IPO NOTE TATVA CHINTAN LTD.

July 15, 2021

Tatva Chintan Pharma Chem Ltd | IPO Note

July 15, 2021

2

Company background

Company was incorporated as ‘Tatva Chintan Pharma Chem Private Limited’ on

June 12, 1996. The company was promoted by Ajaykumar Mansukhlal Patel,

Chintan Nitinkumar Shah, and Shekhar Rasiklal Somani. Currently promoters hold

16,175,850 Equity Shares in aggregate, representing 80.53% of the issued,

subscribed and paid-up Equity Share capital of the company. As of FY21, PTC,

SDAs, and PASC accounted for 27%, 40%, and 30% of revenues from sale of

products, respectively.

Issue details

The issue comprises of offer for sale of upto `275 crore and Fresh issue of 225 Cr

in the price band of `1073-1083.

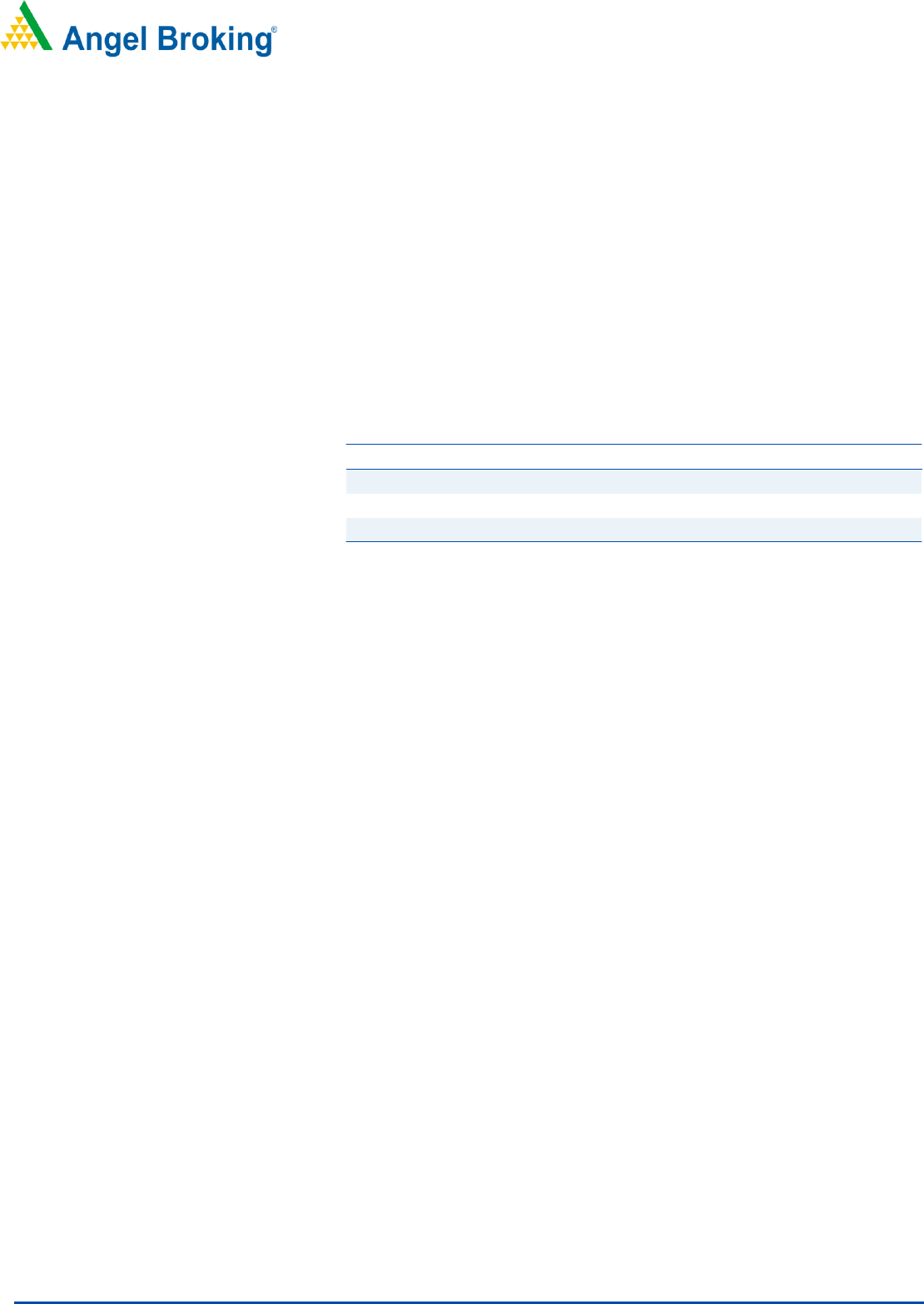

Pre and post IPO shareholding pattern

No of shares

(Pre-issue)

%

(Post-issue)

%

Promoter

20,087,500

100.0

17,548,256

79.2

Public

0

0.0

4,616,806

20.8

Total

20,087,500

100.0

22,165,062

100.0

Source: Company, Angel Research & RHP.

Objectives of the Offer

Funding capital expenditure requirements for expansion of the Dahej

Manufacturing Facility.

Funding capital expenditure requirements for upgradation at the R&D facility

in Vadodara, and

General corporate purposes.

Key Management Personnel

Chintan Nitinkumar Shah is the Managing Director on the Board and has over 24

years of experience. He is responsible for, among others, business development

and finance and information services, in the company.

Ajaykumar Mansukhlal Patel is the Whole Time Director on the Board and has over

26 years of experience. He is responsible for, among others, project engineering

and the development and implementation of new technology, in the company.

Shekhar Rasiklal Somani is the Whole Time Director on the Board and has over 24

years of experience. He is responsible for business development, production

controlling, quality, and supply chain management, in the company.

Mahesh Tanna is the Chief Financial Officer of the company. He has been

associated with the company since December 22, 2020 and has experience of

over 21 years

Subhash Ambubhai Patel is the Independent Director on the Board and has over

33 years of experience in accountancy and audit.

Tatva Chintan Pharma Chem Ltd | IPO Note

July 15, 2021

3

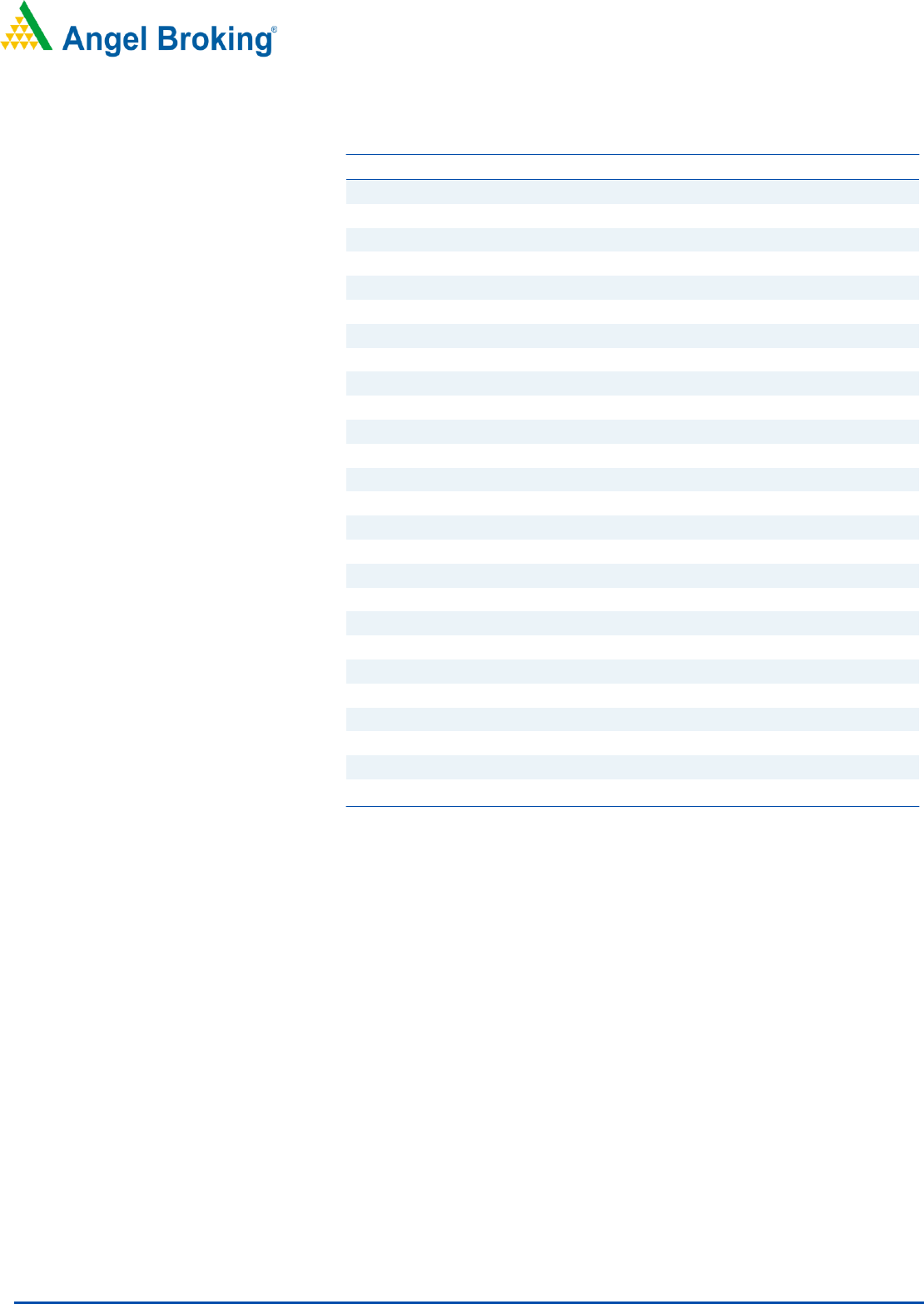

Exhibit 1: Consolidated Profit & Loss Statement

Y/E March (` Cr)

FY2019

FY2020

FY2021

Total operating income

206

263

300

% chg

-

27.6

14.1

Total Expenditure

173

208

235

Cost of materials consumed

118

146

151

Purchases of stock-in-trade

0

2

3

Changes In Inventories

(4)

(16)

(4)

Employee benefits expense

16

21

24

Other expenses

42

55

61

EBITDA

34

55

66

% chg

-

62.6

19.6

(% of Net Sales)

16.4

20.9

21.9

Depreciation& Amortization

4

5

7

EBIT

30

50

59

% chg

-

68.4

17.6

(% of Net Sales)

14.4

19.1

19.6

Finance costs

4

4

4

Other income

0

1

6

(% of Sales)

0.2

0.5

2.0

Recurring PBT

26

46

55

% chg

-

76.7

18.5

Exceptional item

(1)

-

-

Tax

7

10

8

PAT (reported)

21

38

52

% chg

-

84.0

38.3

(% of Net Sales)

10.0

14.4

17.4

Basic & Fully Diluted EPS (Rs)

9.0

17.0

23.6

Source: Company, Angel Research

Tatva Chintan Pharma Chem Ltd | IPO Note

July 15, 2021

4

Exhibit 2: Consolidated Balance Sheet

Y/E March (` Cr)

FY2019

FY2020

FY2021

SOURCES OF FUNDS

Equity Share Capital

8

8

20

Other equity

72

110

146

Shareholders’ Funds

80

118

166

Total Loans

77

91

90

Other liabilities

4

5

4

Total Liabilities

160

213

260

APPLICATION OF FUNDS

Property, Plant and Equipment

54

99

109

Right-of-use assets

12

12

12

Capital work-in-progress

6

5

10

Intangible assets

0

0

0

Non-Current Investments

-

-

-

Current Assets

114

133

184

Inventories

36

64

72

Investments

-

-

-

Trade receivables

41

50

91

Cash and Cash equivalents

16

11

5

Loans & Other Financial Assets

10

3

3

Other current assets

11

6

13

Current Liability

27

36

55

Net Current Assets

87

97

130

Other Non-Current Asset

0

0

0

Total Assets

160

213

260

Source: Company, Angel Research

Tatva Chintan Pharma Chem Ltd | IPO Note

July 15, 2021

5

Exhibit 3: Consolidated Cash flows

Y/E March (`cr)

FY2019

FY2020

FY2021

Operating profit

27

48

61

Net changes in working capital

(22)

(23)

(38)

Cash generated from operations

13

34

34

Direct taxes paid (net of refunds)

(6)

(8)

(10)

Net cash flow from operating activities

7

25

24

Purchase of Assets

(10)

(48)

(21)

Interest received

0

1

(0)

Others

(7)

7

0

Cash Flow from Investing

(17)

(40)

(21)

Repayment (long term borrowings)

13

13

(9)

Repayment (short term borrowings)

8

1

9

Proceeds from issue/repayment debentures

-

-

-

Interest paid

(4)

(4)

(4)

Interest on Lease liabilities

-

-

-

Others

(0)

(0)

(4)

Cash Flow from Financing

17

10

(9)

Inc./(Dec.) in Cash

8

(5)

(5)

Opening Cash balances

8

16

11

Closing Cash balances

16

11

5

Source: Company, Angel Research

Tatva Chintan Pharma Chem Ltd | IPO Note

July 15, 2021

6

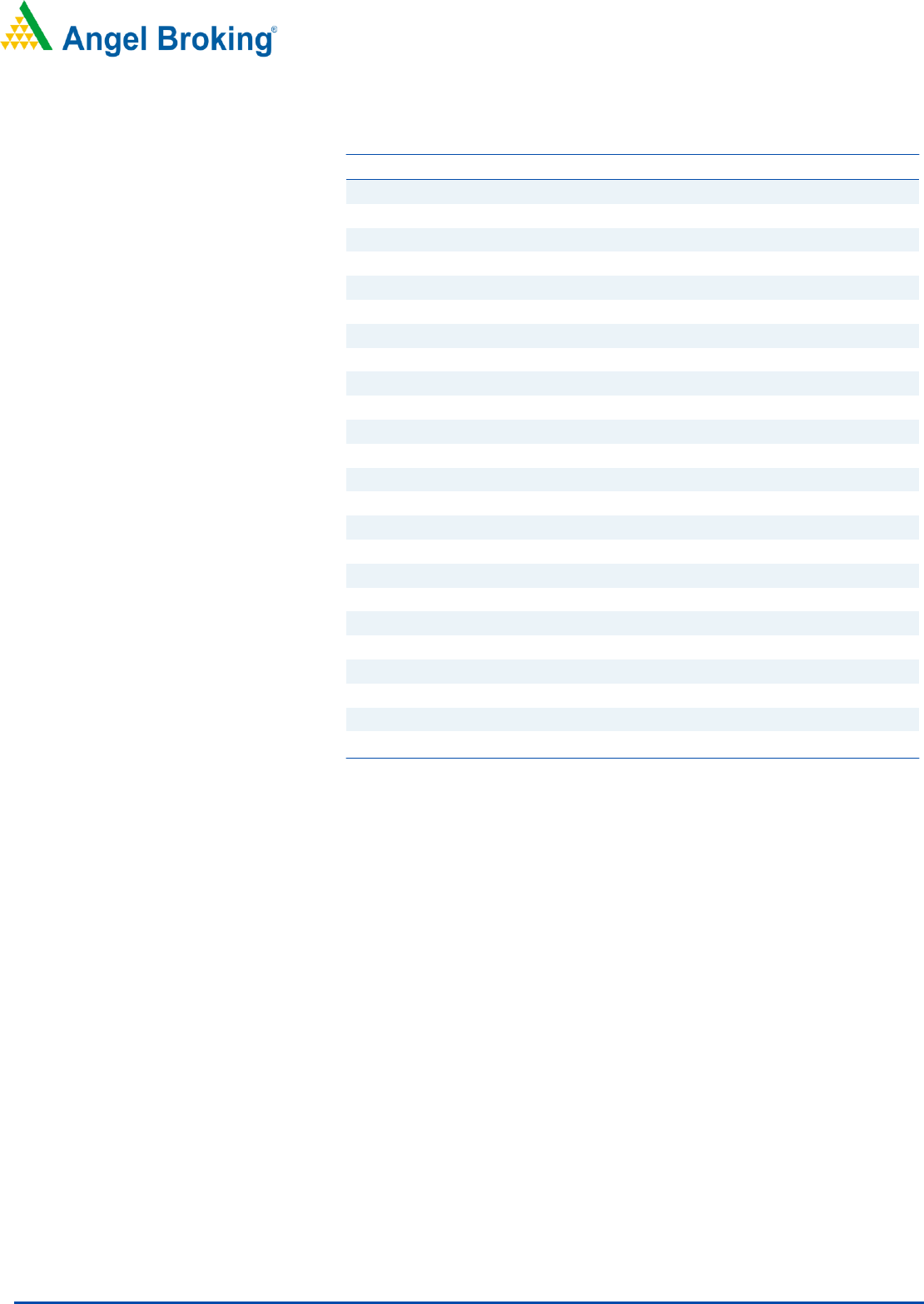

Key Ratios

Y/E March

FY2019

FY2020

FY2021

Valuation Ratio (x)

P/E (on FDEPS)

120.4

63.5

45.9

P/CEPS

100.2

56.4

40.7

P/BV

30.1

20.4

14.5

EV/Sales

11.9

9.4

8.3

EV/EBITDA

72.8

45.1

37.8

Per Share Data (Rs)

EPS (Basic)

9.0

17.0

23.6

EPS (fully diluted)

9.0

17.0

23.6

Cash EPS

11

19

27

Book Value

36

53

75

Returns (%)

ROE

50.0

38.3

36.8

ROCE

29.0

22.4

24.1

Turnover ratios (x)

Receivables (days)

73

69

110

Inventory (days)

75

111

112

Payables (days)

47

55

74

Working capital cycle (days)

101

125

148

Source: Company, Angel Research

Tatva Chintan Pharma Chem Ltd | IPO Note

July 15, 2021

7

Research Team Tel: 022 - 39357800 E-mail: [email protected] Website: www.angelbroking.com

DISCLAIMER

Angel Broking Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay

Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager and investment advisor with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking

Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration

number INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for

accessing /dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed

public offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify,

nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While

Angel Broking Limited endeavors to update on a reasonable basis the information discussed in this material, there may be regulatory,

compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information.